Awareness | Security | Independence

Goal: Financial Capability

“Financial capability is the combination of attitude, knowledge, skills, and self-efficacy needed to make and exercise money management decisions that best fit the circumstances of one’s life, within an enabling environment that includes, but is not limited to, access to appropriate financial services. Put more succinctly: Financial capability is not just what you know, but whether you have the willingness, confidence, and opportunity to act. Attitude is one thing. Confidence in the ability to take action is another.” - Center For Financial Inclusion and Micro Finance Opportunities (MFO’s).

In sum, MFO’s definition states that a financially capable person is someone who:

Sees the value in managing money proactively (attitude);

Knows what is needed to make appropriate money management decisions and act on them;

Has the skills to turn that knowledge into practice;

Believes and has confidence that she or he is able to act on that desire (self-efficacy); and

Has access to an environment that enables them to act on that desire.

A financially savvy woman is well versed in dealing with expenditures, credit, and other money matters. The overall goal of being savvy financially focuses on one concept: having the knowledge, skills, and confidence for maintaining a healthy financial standing through proper planning and budgeting.

5 Broad Categories of the Financial Well-Being program:

Managing Money

Planning Ahead

Making Choices

Avoiding Pitfalls

Getting Help

The Financial Well-Being program provides women coaching, knowledge of financial tools, and tiny habits to achieve financial security and eventually economic mobility.

Giving women the power to support themselves, their children, and to move up the economic ladder.

Program: Financial Security & Resilience

Increased Financial Wellness = Increased Financial Knowledge and Positive Financial Skills + Increased Confidence + Increased Motivation +Increased Positive Financial Behaviors

We aim to empower women by making money management easy to understand and apply to their lives. We believe that with the proper resources and education, anyone can overcome financial struggles and start on a path for financial security and independence.

We have designed our Financial Well-Being program to cover finance basics for women to achieve financial security and independence and grow wealth. Our comprehensive workshops incorporate textbook approaches with real-life scenarios, taught by industry professionals.

Each module includes:

· Session on the topic of the month (Basics of Banking, Credit 101, Debt, Renting, Budgeting, Taxes etc.)

· Individual one-on-one coaching sessions

· Group debrief and action plan

Each 1-on-1 coaching session aims to:

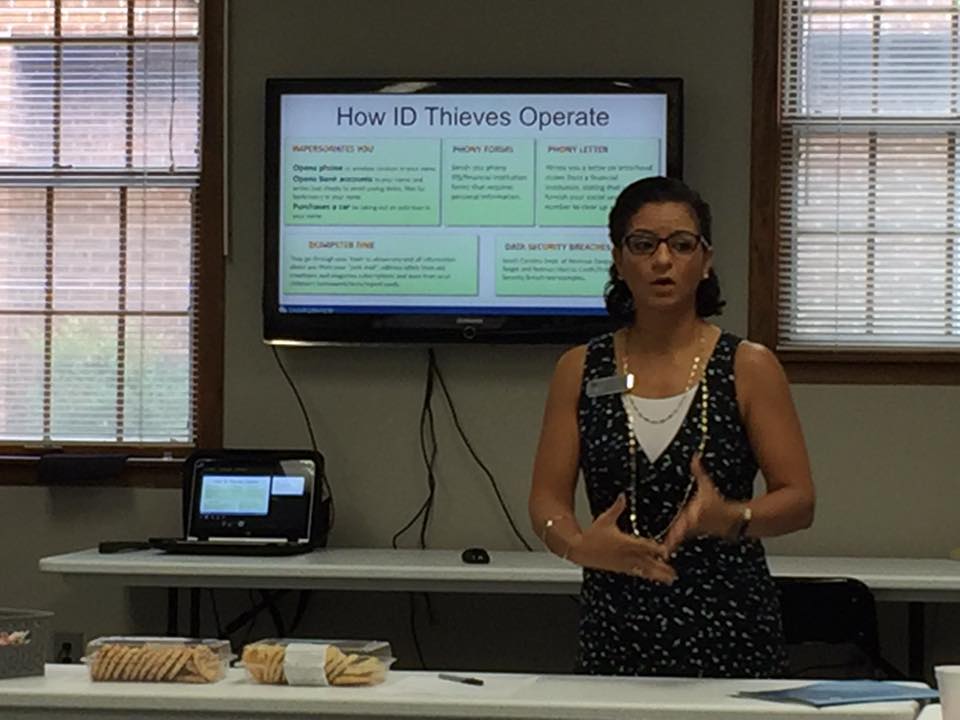

· Develop knowledge of financial products and tools

· Understand and avoid common pitfalls

·. Awareness and prevention of scams

· Practice skills that lead to healthy money management

· Provide practical advice and solutions for everyday issues

Financial Capability Research

“Managing one's finances is a complex set of challenges in the best of the times, requiring a combination of skills, judgment, and resources. In today's volatile economic environment, the challenges are especially acute and the downside risks are great. Individuals and families must grapple with a bewildering variety of financial decisions, ranging from choosing a bank and managing various kinds of debt to planning for retirement and purchasing insurance. Even the simplest of these decisions requires at least some basic financial knowledge and competency, while the more complicated decisions are challenging even for experts. Financial capability cannot be measured simply by looking at one indicator, such as demonstrated knowledge of specific terms or concepts. Instead, financial capability encompasses multiple aspects of behavior relating to how individuals manage their resources and how they make financial decisions (including the factors they consider and the skill sets they use). It is a multi-dimensional concept that requires looking at individual behavior from various angles.” - FINRA

“Financial capability is measured in terms of how well people make ends meet, plan ahead, choose and manage financial products, and possess the skills and knowledge to make financial decisions. The findings reported in this work paint a troubling picture of the state of financial capability in the United States. The majority of Americans do not plan for predictable events such as retirement or children's college education. Most importantly, people do not make provisions for unexpected events and emergencies, leaving themselves and the economy exposed to shocks. To understand financial capability, it is important to look not only at assets but also at debt and debt management, as an increasingly large portion of the population carry debt. In managing debt, Americans engage in behaviors that can generate large expenses, such as sizable interest payments and fees. Moreover, more than one in five Americans has used alternative (and often costly) borrowing methods (payday loans, advances on tax refunds, pawn shops, etc.) in the past five years. The most worrisome finding is that many people do not seem well informed and knowledgeable about their terms of borrowing; a sizable group does not know the terms of their mortgages or the interest rates they pay on their loans. Finally, the majority of Americans lack basic numeracy and knowledge of fundamental economic principles such as the workings of inflation, risk diversification, and the relationship between asset prices and interest rates.” - National Bureau of Economic Research (NBER)

Team

Haley Henderson - DOLE Food Company

Haley is a Certified Public Accountant (CPA) and is currently working for Dole Food Company as a Senior Financial Reporting Analyst. She holds a Master's Degree in Accounting from George Washington University and a Bachelor's Degree in Business Administration. She’s excited to work with FFG to help women reach their full potential by helping to provide critical financial literacy skills needed to succeed!

Haley’s Statement:

“After moving to Charlotte in August 2020, I wanted to find ways to give back to my new community. I found FFG through the Share Charlotte website, where I originally volunteered to make FFG care packages for women and children in need. I became excited after meeting the FFG team and learning more about part of their mission to provide important programs for women, so they may work to become financially independent. Working with FFG has allowed me to use my background in accounting to help develop educational workshops for participants, while also working one-on-one with them to discuss important everyday life financial skills. I admire the work FFG does in helping develop and empower women to become successful and financially sound individuals.”

Letitia Morris - Bank of America

Letitia is a native of New York City, from Bronx, NY and relocated to the Charlotte area by way of Buffalo, NY where she lived for 20 years. She holds a Bachelors of Arts in Legal Studies and a Masters in Business Administration with a concentration in Public Administration. Also, Letitia recently embarked and bought into a franchise that serves to educate as well as assist people with restoring their credit and getting in a position to pursue their dreams. With all of this, she also works at Bank of America in Global Compliance and Operational Risk.

Letitia’s Statement:

“I believe I was in the right place at the right time to connect with someone who is also a coach for FFG. After hearing the mission of FFG it was obvious to me that this was an opportunity to share my story, my experiences...good or bad and tell women of all ages what I have learned. Unfortunately, I did not have the opportunities that many women have today, such as life coaches, but I have been blessed and I have no right to not reach back and help and guide those whose paths may be similar but most of all need a little guidance and encouragement.”

Kaitlyn Harrow Chami - Wells Fargo

Kaitlyn is currently a VP of Sustainable Finance & Advisory at Wells Fargo. She received her Master of International Business and B.S. in Finance from the University of Florida. She defines her own success by how much she’s helped others succeed and grow. FFG holds a special place in her heart!

Kaitlyn’s Statement:

“In September 2017, I had the good fortune of meeting FFG at a volunteer fair hosted by Wells Fargo to bring together volunteer organizations in the community. I immediately fell in love with FFG's vision and values, and began volunteering as an assistant teacher. I attribute where I am in life today to the educators and mentors that have guided me over the years. I am passionate about empowering young women to reach their own financial independence and keep growing to conquer their dreams. Many of the tools that we need to achieve financial independence are not taught in school. I've watched students grow from saving their spare change in pickle jars to having their own savings account, feeling confident they are prepared with emergency savings funds, taking control of their credit score, driving their own budgets, and striving to strengthen their personal balance sheets. I am so proud of our students and the family that FFG has forged to empower young women!”

Cara Cremeans - NorthWESTErn MutUal

Cara joins the team with a background in sales, analytics, and coaching Division I cross country and track. Grateful for mentors who inspire and guide her career, service, well-being, and leadership, she loves helping others realize their potential to grow and give back. Cara resides in Charlotte and works for Northwestern Mutual.

Cara’s Statement:

“Courage, kindness, and consistency are three values I share with FFG that make working with our participants and coaches rewarding. Every girl who participates at a session has the courage to better themselves and our caring coaches help nurture that. The FFG family continues to grow because we establish essential life skills in the girls, which instills confidence in them to pursue their goals and ambitions. I have mentors who invest in me, for whom I am incredibly grateful; this is my way of sharing what others have shared with me--it is how I say 'thank you.' In volunteering, I have stronger connections to our Charlotte community and earnest awareness of others' reality. Awareness is one thing, but feeling the feelings of what these girls have felt, what they have gone through, that's where FFG has grounded me. It empowers me when I relate to under-served ladies with great ambitions, because we have incredibly similar goals.

Erin Watkins - Bank of America

Erin is a financial analyst at Bank of America on the Commercial Real Estate Banking Finance team. Erin has been with Bank of America in Charlotte since graduating from Clemson University in May 2015, where she majored in Financial Management with a focus on Financial Planning.

Kim Marks - Wells Fargo

Kim is a Risk and Control Senior Associate at Wells Fargo Asset Management. She received her MBA and B.S. in Finance from the University of Wisconsin Milwaukee and has lived in Charlotte for 5 years. She is motivated to empower women and young moms by giving them the tools to create successful lives for themselves and their families.

Hayley Hinson - Bank of America

Hayley currently works as a Financial Analyst on the Commercial Real Estate Banking team at Bank of America. She returned to Charlotte, where she is originally from, after graduating from Clemson University with a degree in Financial Management in 2019. Hayley is excited to invest in FFG participants and play a key role in coaching young single moms to be financially savvy to enable multi-generational impact.

Adele Marchant - GOODWIN LLP

Adele graduated from Duke University’s Law School and is now an Associate Attorney at Goodwin LLP. She’s also a commissioned artist. Adele is a Georgetown grad with a B.A. in Government and Studio Art. She has lived in her hometown of Charlotte, Washington, D.C., Durham, Dallas, and New York City. Adele believes that a great support system of women mentors like FFG is the best asset for all of us to thrive personally and professionally!

nicole cervi - Wells Fargo

A recent graduate of UNC-Chapel Hill, Nicole is a committed public servant who aims to empower women through building sustainable partnerships.

Lauren Aten - Deloitte Consulting

Lauren graduated from NC State in 2018, where she obtained her Bachelors and Masters degrees in Accounting. Originally from Waxhaw, NC, she moved back to Charlotte after college to work at Deloitte in their Audit practice. Lauren is excited to join the FFG team and invest in young women on their path to financial independence.

Christina mcconnell - Wells fargo Advisors

Christina started her career with the firm in 1992 as a fixed-income trader and co-manager of a multi-million dollar mutual fund portfolio. She became a financial advisor with Wells Fargo in 1997. As a financial advisor, Christina specializes in comprehensive retirement planning and asset allocation analysis, providing her clients with a variety of products and financial services. She is dedicated to building long-term relationships with clients to help them achieve their financial goals and lifetime dreams. In addition to her bachelor's degree in Mathematics from East Carolina University, she holds Series 7, 63 and 65 security registrations, as well as life and health insurance licenses.

laura long - Wells Fargo Advisors

Laura joined Wells Fargo Advisors in 2009 as a Financial Advisor relocating from San Diego, California. Laura holds a Master of Business Administration degree with a Bachelor of Science degree in Marketing and Statistics. Laura became an advisor because of how much she enjoys educating and helping others about saving and investing for retirement. This is why she became involved with FFG—to provide an outlet to teach young women about saving and investing in hopes of creating a better future for them and their children.

CARLY FERRIGAN - Grant Thornton

Carly is from Syracuse, New York and recently graduated from the University of South Carolina. She moved to Charlotte at the end of July 2020 to pursue a full-time time career in Public Accounting. Carly is looking forward to working with and learning from women of all different ages and backgrounds! FFG leaves me feeling empowered!

montanna Saltsman - fidelity investments

Montanna is an ETF Associate at Fidelity Investments. She received her Masters in Finance and B.S. in Finance from Auburn University. She’s excited to join the FFG team and help economically empower women to be their best selves with personally and professionally.